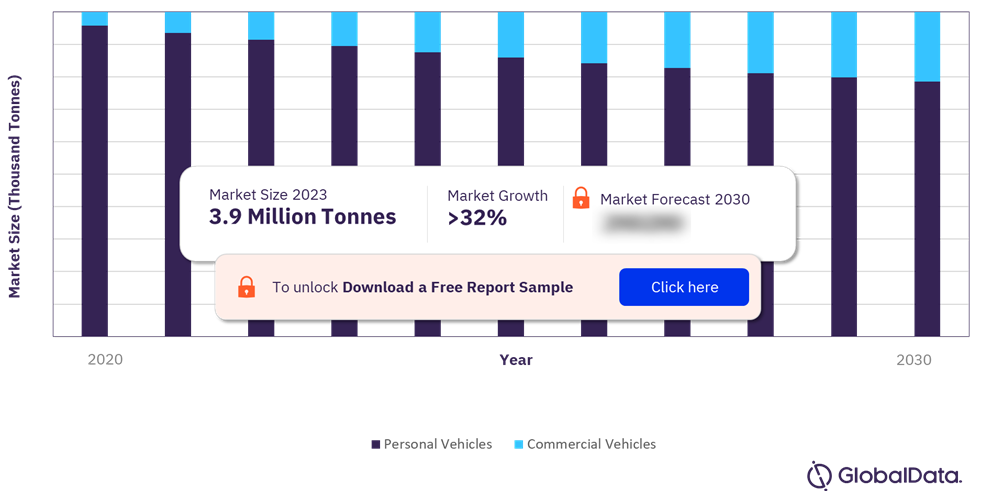

The global metals in EV battery market size is estimated to be 3.9 million tonnes in 2023, according to a new report by GlobalData Plc. The global demand for EV batteries, especially in the personal vehicle sector, is on the rise. Growing environmental consciousness and the shift towards sustainable transportation are factors anticipated to drive market expansion in the projected timeframe.

Global Metals in EV Battery Market Share By Type, 2020 – 2030 (%)

Metals in EV Battery market outlook report with detailed type, and application segment analysis is available with GlobalData Now! Read our Free Sample Report

Metals in EV Battery Market FAQs

- What will be the metals in EV battery market size in 2023?

The metals in EV battery market size globally will reach 3.9 million tonnes in 2023. - What is the metals in EV battery market growth rate?

The metals in EV battery market is expected to grow at a CAGR of 32.9% during the forecast period (2023-2030). - What is the key metals in EV battery market driver?

The increasing focus on environmental consciousness and the transition towards sustainable transportation are expected to be key drivers responsible for the expansion of the metals in EV battery market during the forecast period. - What are the key metals in EV battery market segments?

- Metal Type Segments: Lithium, Nickel, Cobalt, Manganese, Aluminum, Others

- Battery Type Segment: Lithium-ion (Li-ion) Battery, Nickel-metal Hydride Battery, Others

- Application Segments: Personal Vehicles, Commercial Vehicles

- Which are the leading metals in EV battery companies globally?

The leading metals in EV battery companies are Glencore International AG, Sociedad Quimica y Minera de Chile (SQM), Albemarle Corporation, Ganfeng Lithium Co. Ltd., AngloAmerican PLC, Tianqi Lithium Corp., Vale S.A., China Molybdenum Co., Ltd., Eurasian Resources Group, Norilsk Nickel, Eramet, and Freeport-McMoRan.

Have more queries? Get all your questions answered in this PDF Sample Report

Metals in EV Battery Market Dynamics

Battery performance and cost have become crucial factors that set apart companies in the battery metal industry. Various chemistries and construction techniques are competing to establish themselves as the new industry benchmark, striving to maximize the capacity and lifespan of their products while simultaneously reducing production costs.

Increasing investments in EV batteries have reached a relatively advanced stage compared to other future mobility sectors like autonomous vehicles. Consequently, they offer a more defined path towards achieving a return on investment in the forecast period. Similarly, investments in the mining industry for extracting metals used in EV batteries are witnessing substantial growth. However, establishing a fully functional mining project requires several years, indicating that the investments are expected to yield profitability in the latter half of the decade.

Learn about the metals in EV battery market dynamics by viewing report sample right here!

Metals in EV Battery Market Report Highlights

- The global Metals in EV Battery market is expected to be driven by a compound annual growth rate (CAGR) of 32.9% from 2023 to 2030. The increasing demand for metals used in electric vehicle (EV) batteries is fueled by their sustainable attributes and the growing number of agreements to prohibit the sale of combustion-powered vehicles.

- The lithium-ion batteries segment dominated the market in 2022 and is anticipated to maintain its leading position throughout the forecast period from 2023 to 2030. This segment holds the largest market share due to its widespread adoption and recognition in various end-use applications. Lithium-ion batteries are composed of metals such as lithium, nickel, manganese, cobalt, and aluminum. The prominent players in the lithium-ion battery market are LG Chem, Panasonic, and Samsung SDI.

- The commercial vehicle segment is anticipated to exhibit a high compounded annual growth rate of 49.0% during the forecast period. This growth is driven by the increasing emphasis on reducing carbon emissions in the commercial transportation sector by governments and environmental conservation organizations. These efforts are expected to bolster the growth of this segment throughout the forecast period.

- The Asia Pacific region held the largest share in terms of volume in 2022. This region is home to significant mining operations in countries like China and Australia, which possess advanced mining infrastructure and abundant mineral resources. These countries play a crucial role in the higher production of metals used in EV batteries.

Unlock additional market dynamics impacting the metals in EV battery market growth by requesting a sample PDF

GlobalData Plc has segmented the metals in EV battery market report by metal type, battery type, application, and region:

Global Metals in EV Battery, by Metal Type Outlook (Volume, Thousand Tonnes, 2020-2030)

- Lithium

- Nickel

- Cobalt

- Manganese

- Aluminum

- Others

Global Metals in EV Battery, by Battery Type Outlook (Volume, Thousand Tonnes, 2020-2030)

- Lithium-ion (Li-ion) Battery

- Nickel-metal Hydride Battery

- Others

Global Metals in EV Battery, by Application Outlook (Volume, Thousand Tonnes, 2020-2030)

- Personal Vehicles

- Commercial Vehicles

Metals in EV Battery Regional Outlook (Volume, Thousand Tonnes, 2020-2030)

- North America

- S.

- Canada

- Europe

- Germany

- UK

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Australia

- India

- Korea

- Rest of Asia Pacific

- Central & South America

- Brazil

- Rest of Central & South America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Get Segment-wise insights and metals in EV battery market scope as you grab your sample report copy

Related Reports

- Electric Vehicles Market Analysis by Region, Propulsion Type (BEV, FHEV, MHEV, PHEV, EREV, FCEV), End-user Type (Personal, Commercial) and Forecast to 2030

- Lithium Mining Market by Reserves and Production, Assets and Projects, Demand Drivers, Key Players and Forecast to 2030

- Cobalt Mining Market Analysis including Reserves, Production, Operating, Developing and Exploration Assets, Demand Drivers, Key Players and Forecasts, 2021-2030

About us

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. In an increasingly fast-moving, complex, and uncertain world, it has never been harder for organizations and decision-makers to predict and navigate the future. GlobalData’s mission is to help our clients to decode the future and profit from faster, more informed decisions. As a leading information services company, thousands of clients rely on us for trusted, timely, and actionable intelligence. Our solutions are designed to provide a daily edge to professionals within corporations, financial institutions, professional services, and government agencies.

Contact Information:

Media Contacts Mark Jephcott Head of PR EMEA [email protected] cc: [email protected] +44 (0)207 936 6400

Tags:

Reportedtimes, iCN Internal Distribution, Extended Distribution, Research Newswire, English